ConsumerInsight has been conducting a‘Travel Behavior and Syndicated Study’ every week (500 samples per week, 26,000 samples per year) since August 2015 to understand the status of the travel market and predict changes. This Megatrend Report is intended to comprehensively understand the current status and development of the tourism market based on 2020 surveys.

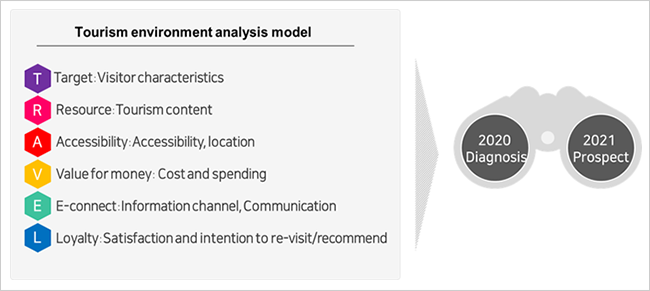

- [Travel Consumer Trend Analysis Model T·R·A·V·E·L]

-

-

ConsumerInsight has developed and used a six critical areas analysis model <6 TCT ; T-R-A-V-E-L> by analyzing data from independently conducted surveys to understand travel consumer dynamics and predict changes in trends.

-

In this model, six key elements were derived based on the combination of environment, industry, and people that determine consumers` travel behavior and attitude. This model will be used to review present conditions and predict future ones. The six elements directly influence each other and move the industrial structure dynamically. They can be used to reasonably predict consumer behavior and the market by taking a macroscopic view with an integrated understanding.

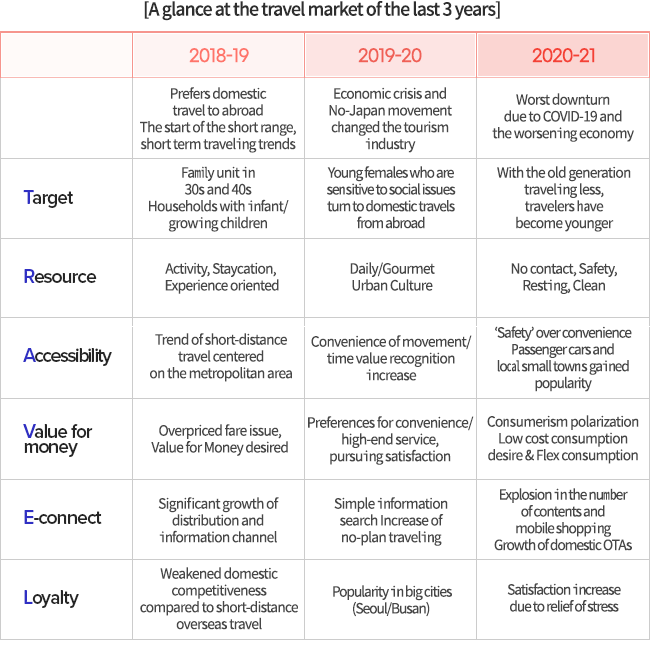

I. 2019 to 2011 Domestic Travel Megatrend Summary

II. 2020-2021 Trends and Prospect Summary

-

1. As is : 2020 Trends

-

Consumer sentiment declined after 2018 due to the domestic economic slowdown, and the tourism market was devastated after the outbreak of COVID-19 in early 2020.

-

`Staying home` became the key trend in line with social changes such as refraining from gathering and working from home. Traveling is recognized as a dangerous activity that could potentially spread the virus.

-

While ‘pursuing pleasure` and `finding excitement` was the purpose of traveling in the past,‘avoiding risks` and `safety` are now the main priorities. Based on this sentiment,‘Relaxing/Resting` and `Wellness` concepts became significantly popular.

-

The outlook of COVID-19 is pessimistic due to it being a prolonged pandemic, and it’s difficult to foresee when traveling overseas will be normalized. “Virtual tour” and “No-landing cross-border flight”services have been launched as alternatives to satisfy the desire to travel, but it is unclear whether these will be temporary solutions or will become a new travel trend.

-

With declined consumer sentiment, consumers tend to show a `low-cost` consumption trend, but at the same time, there are stress-relief consumptions and Flex (show-off) consumptions, showing polarized trends.

-

2. To be : 2021 Prospect

-

The tourism industry was the most affected by COVID-19 among all industries in 2020, and the recovery of the market is unlikely due to the pessimistic outlook on the economy and declined consumerism.

-

After the outbreak, traveling has changed from Enjoying (Sightseeing/Entertainment/Eating) to Resting (Wellness/Relaxing). It is expected that travelers will continue to minimize contact with others and have a high tendency to travel where they have full control of their surroundings.

-

With the increase in short-term and short distance traveling, the `alternative to overseas travel (PLAN B)` market also grew, showing the potential for market polarization (long-term traveling, luxury/flex travel, etc.)

-

After the COVID-19 outbreak, less well-known (hidden) travel destinations were preferred over famous attractions, allowing local/small towns to find new opportunities. Moreover, leisure-tourism policies and marketing that can satisfy local/nearby residents seem to be more effective than attracting tourists from out-of-town.

III. Trends and Prospect Through T.R.A.V.E.L Model

-

1. [T]RAVEL : Target(Travellers)

-

[Environment]

-

Travel consumers are suffering from both the pandemic and the economic crisis. Consumers want to go somewhere, but not only are their pockets empty, they also have nowhere to travel that allows them to maintain social responsibilities (pressure to stay home and follow social distancing.)

[Phenomenon]

-

As traveling has become difficult for everyone, the market contracted to its lowest level ever, and a significant change in primary consumers has taken place.

- The elderly in their 50s and 60s, who are vulnerable to health conditions, declined more. In comparison, women in their 20s and 30s, who were the biggest consumers of overseas travel, changed their destinations to domestic ones, and the importance of the Millennial travel (“MZ Generation“) increased.

-

Leisure-type travel, in which travelers make very abbreviated trips and enjoy traveling within their residential area, has become a trend.

[Prospect]

-

As leisure-type travel continues, hosting out-of-town visitors has become more difficult, and local/nearby residents` importance is growing.

-

Economic polarization, which has become more severe after COVID-19, will lead to polarization in the travel market. Travelers are divided into a `Desire to Travel group` or a `Give-up on Travel group`. As for demographics, the polarization between white-collar workers in their 20s-30s and those in their 50s or older with low income became enlarged, and it will be difficult for the market to recover to the same level as in the past.

-

2. T[R]AVEL : Resource

-

[Environment]

-

Returning to daily life as in the past is now impossible due to the government`s COVID-19 countermeasures, such as limited facility operation hours and restrictions on the number of people gathering.

-

There are also traveling restrictions for routines, companions, and activities; and no local events like festivals are allowed anywhere, so‘available content to enjoy’ during trips has significantly decreased.

[Phenomenon]

-

While tourism activities have significantly decreased, wellness/resting traveling was increased, and no contact with others was pursued throughout the trip.

-

Travelers tended to avoid crowded cities or famous attractions, instead scattering to rural areas and small cities for traveling.

-

Having full control over their environment and having no contact with others became the new criteria when choosing a travel destination rather than the place`s attractiveness. As a result, the demand for hobby/exercise activities that you can enjoy outdoors on a small scale has increased.

[Prospect]

-

Consumers are responding promptly to quick environment changes. Traveling to places where consumers have full control while having no contact with others, such as camping, will continue to be popular.

-

It will take a long time for international travel to be normalized again, and alternative travel services such as “Virtual tour” and “No-landing cross-border flight” will be diversified.

-

Even if the price is high,‘safety-guaranteed’environment and luxurious service are in demand. The growth of exotic and luxury travel service is expected.

-

3. TR[A]VEL : Accessibility

-

[Environment]

-

It is advised to refrain from traveling between regions, and the public transportation between local cities has been reduced as a countermeasure of COVID-19.

-

People are afraid to use public transit and to be stuck with random people in a small, crowded space.

[Phenomenon]

-

Travelers prefer their vehicle over public transit to have full control of the environment. This is related to car sales surpassing 1.9 million units for the first time in history in 2020 despite the economic downturn.

-

More travelers tended to travel within their residential area due to the fear of the virus and tended to travel to unknown and quiet places, avoiding cities.

-

Accessibility is an important factor when choosing a destination, but with fewer activities during trips nowadays, the importance of `accessibility to attractions` when choosing accommodation and restaurants declined.

[Prospect]

-

The tendency to rely on private transportation rather than public transit is expected to continue until the end of the pandemic.

-

With significantly more travelers driving, traffic and parking space in regions are expected to become the major factor that influences travel satisfaction.

-

Eco-friendly small towns, remote regions, and isolated places suitable to avoid contact are newly rising. These areas will increase in competitiveness as travel destinations once accessibility is improved.

-

4. TRA[V]EL : Value for money(Cost and spendings)

-

[Environment]

-

All consumption expenditures declined due to the COVID-19 and economic crises, but the biggest drop among them was travel expenses.

-

Not only did spending decline, but consumers also had difficulty deciding what to spend money on. It was the worst particularly for overseas travel.

[Phenomenon]

-

Extreme low-cost flight tickets to Jeju due to decreased demand as well as overpriced fares at tourist attractions virtually disappearing made planning a value-for-money trip pointless.

-

On the other hand, consumers who saved a lot of money for their travel budget spent their savings on cars and luxury goods for stress relief.

[Prospect]

-

The polarization of the tourism market will occur not only in the traveling period but also in the spendings. : In the same context as the increase in both super-short and long-term trips (5 nights or more) in the travel period, cost expenditure can be polarized into low-cost leisure-type travel and high-cost travel (substitute for overseas travel).

-

There are consumers who are willing to pay a much higher cost if there is an exceptional travel product/service that guarantees `safety` and `fun`.

-

5. TRAV[E]L : E-connect (Information channel/Communication)

-

[Environment]

-

Smartphone not only has become an essential part of traveling but also in our lives. Non-face-to-face consumption is promoted, and middle-aged people became new digital consumers.

-

As video content and YouTube proliferated, consumers used video content for both leisure culture content and information searching.

[Phenomenon]

-

There was a significant increase of consumption via mobile devices and the development of mobile devices technology, but distribution and information channels have lost their vitality due to a decrease in travel demand.

-

Global Online Travel Agencies (OTA) stagnated due to no overseas traveling, and domestic OTAs now lead the market.

-

As travelers avoid crowded areas, interest in unknown destinations/restaurants has increased. As a result, word-of-mouth was more significant than the information on the internet when searching for destinations.

[Prospect]

-

Consumers who mainly shop on mobile devices and use domestic OTA platforms for traveling are unlikely to return to their past consuming patterns even after the pandemic is over.

-

Ability to use digital technology will determine competitiveness, and quickly satisfying consumers’ needs with creative content will be the surviving strategy in the new ‘post-COVID-19’ era.

-

New tour products/services such as online festivals and virtual tours using VR/AR technology will be the upcoming new market.

-

6. TRAVE[L] : Loyalty(Satisfaction and intention to re-visit)

-

[Environment]

-

As the pandemic is prolonged, people are struggling from depression and stress accumulated from following the restrictions such as social distancing.

-

While traveling for relaxing and wellness became the norm, the criteria for evaluating travel destinations has changed.

[Phenomenon]

-

Satisfaction/recommendation/re-visit intention for domestic travel has increased after the COVID-19 outbreak even without special activities because travelers feel relieved since they can realize their desires for traveling and freedom.

-

While sightseeing/entertainment/eating were the main factors that affected travel satisfaction in the past, the travel destination`s pleasant environment is now the most critical factor rather than the tourism resources.

[Prospect]

-

Travel destinations for `wellness` where there is no contact with others will continue to be popular for the time being.

-

Demand to find `my own secret spot` within one’s residential area will continue, and a new resource development that will attract local/nearby residents to re-visit is required.

※ Reference. 2020 Basic Study Analysis Report

- T. (III. Domestic travel behavior) 1. Domestic travel experience rate (p.10) 3. Travel areas (p.11)

- 10. Main activities during traveling (p.15)

- (VI. Overseas travel plan) 1. Overseas travel planning rate (p.53)

- R. (III. Domestic travel behavior) 3. Travel areas (p.11) 3. Companions (p.11)

- 9. The reason to choose the destination (p.14) 10. Main activities during traveling (p.15)

- 12. Transportation to the destination (p.16) 13. Transportation in the destination (p.16)

- 14. Accommodation (p.17) 15. Criteria for selecting a place to stay (p.17)

- A. (III. Domestic travel behavior) 3. Travel areas (p.11) 4. Accommodation (p.17)

- 9. The reason to choose the destination (p.14) 12. Transportation to the destination (p.16)

- 13. Transportation in the destination (p.16) 15. The reason to choose the destination (p.17)

- 16. Criteria for selecting restaurants/food (p.18)

- V. (III. Domestic travel behavior) 4. Travel period (p.12) 20. Total travel cost (p.22)

- 21. Travel cost rate by item (p.22)

- E. (III. Domestic travel behavior) 9. The reason to choose the destination (p.14) 18. Reservation/purchase channel by product (p.19)

- 19. Reservation/purchase method by product (p.21)

- L. (III. Domestic travel behavior) 28. Destination satisfaction (p.26) 29. The intention to revisit of destination (p.27)

- 30. The intention to recommend of destination (p.28)

|