ConsumerInsight has been conducting 'Travel behavior and planning study' every week (500 sample per study) since August 2015. This report is based on the data collected in 2017 and 2018 (52,000 respondents), analyzing how Korean consumers traveled overseas and have planned a trip, according to ConsumerInsight's tourism market competitiveness analyzing 6 KCF (Key Competition Factor).

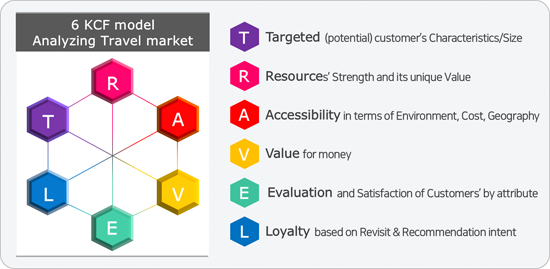

Ⅰ. 6 KCF analyzing T·R·A·V·E·L Model

Tourism market competitiveness analyzing model 'T.R.A.V.E.L'compares and evaluates the competitiveness of all products including travel destinations, travel packages, content, and service etc, by the following 6 dimensions.

In order for a travel market to be competitive, it should have an outstanding strength at least 1 out of the 6 divisions with no critical weaknesses in any of the divisions

Ⅱ. Overseas travel 6 KCF Analysis

● 2019 Total Travel Spending Intent has declined, unable to continue from the 2018's rising trend. This was due to the downturn of domestic travel but overseas travel was not optimistic, either.

● Free individual travel is on a rise. Travellers' increased experience in overseas travel help them have less difficulty in planning their trips and purchasing packages on their own, without travel agencies' or experts'help. With the activation of OTA/Meta-search, the pre-purchases of tickets, beauty products and performance/ exhibitions as well as hotel and flight ticket bookings has become convenient, and those purchases are in a quick transition from PC to mobile.

● Travellers prefer overseas destinations that are cheap as well as short in distance and travel period, with Vietnam getting good attentions in particular, because of the travellers'increased cost-consciousness. On the other hand, Japan, which has been a choice by approximately 30% of the overseas travelers, is expected to see a significant change due to travellers' sluggish satisfaction and travel plan for the country.

Ⅲ. Main Findings of Overseas travel 6 KCF

1. Target ; Travelers

Last year, both Travel Experience and Planning increased slightly (Experience ▲0.8% points; Planning ▲1.0% points), but less than before. Similar to the domestic travel market (Experience ▽3.1% points; Planning ▽3.4% points), the overseas travel market is also expected to slow down this year.

Traveling is still more done by females and those in their 20s and 30s, but we see an increase among those in their 40s and 50s and family trips. In particular, males in their 20s, and 40s to 50s travelled more by 2.0% points or above, whereas females in their 20s to 30s showed a declining trend (females in 20s ▽1.8% points; females in 30s ▽1.2% points), indicating a change in the demographics of the travel market.

59.2% of the overseas travellers traveled individually, marking 2.8% point increase from the previous year. Free individual travel, in particular, rose significantly among those in their 50s(▲4.1% points) and 30s (▲3.6% points). On the other hand, the declining trend continued for group package trips down to 33.5%(▽1.6% points) and partial package tours such as Air-tel etc, to 7.3%(▽1.2% points).

The trend of shorter travel preparation and period is emerging. When 'time left until the departure'was asked to those with specific travel plans in the past one year, the time was decreased from 12.6 weeks to 11.9 weeks, evidencing the reducing travel preparation time. Travel companies should also tailor their marketing efforts to cope with the given changes.

2. Resource

The main purposes of overseas travel were 'To relax(20.3%)', 'To appreciate natural scenery(17.1%)', and 'To enjoy good food and drink(13.6%)' in order. Compared to the previous year, 'To relax(▲1.1% points)', 'To enjoy good food and drink(▲1.0% points), and 'To enjoy theme park, hot spring etc.(▲0.5 points)' increased and 'To appreciate historic sites and remains(▽1.2% points)', and 'To enjoy city landscapes(▽0.9% points)'decreased. In the past, visiting famous tourist attractions was the main activity, but now travels for a rest to relax and to enjoy good food and drink are spreading not just in the domestic travel market but also in the overseas.

Low prices are becoming more important in choosing travel destinations. 8.0% of the total respondents mentioned 'low prices'a main reason for their destination choice, which was the biggest increase at a 1.6% point. Vietnam, the second most visited destination to Japan, was said to be travelled by 27.2% because of its low prices, which explains that the country' as recent popularity is mainly due to its low local prices.

3. Accessibility

More than three-quarters (75.5%) of the overseas travel experience was done in Asia, 1.4% point up against the previous year. In particular, Vietnam is expected to firmly maintain its 2nd place after Japan, with its significant increase in Experience(▲3.3% points) and Plan(▲3.1% points), among short-distance travel destinations.

With the development and the popularization of OTA/Meta-search technology, the accessibility to Information/product search·Reservation/payment has increased.

The OTA/Meta-search usage grew rapidly in each product category, including accommodation (▲6.8% points), local transportation (▲6.4% points), and air ticket only items (▲3.8% points), making it a 'Must Use'in overseas travel preparations. This is because OTA/Meta-search is quickly changing to a mobile platform which is convenient to use. Still, travel products were bought on PC at 52.7% and mobile at 32.4%, but in the past one year, PC dropped by 3.2% points whereas mobile rose by 5.6% points when it came to travel product purchases.

The influence of TV broadcasting is growing as an information search channel. Such information channels as Travel Information site/App(42.7%) such as TripAdvisor etc., Blogs(35.6%), and Community/Cafe(34.1%) were rated as having potential to be used more in order, but all of them declined by 2.0% points or more against last year.

On the other hand, TV broadcasting went down in the ranking, with 24.8%, but it was the only channel that rose in travellers' intent to use among the information channels, which is attributed to the overflowing travel-related entertainments and home shopping advertisements on TV.

4. Value for money

Overseas travel planning and experiences did not decrease, but a tendency to reduce travel costs is emerging. In 2018, 42.3% of the respondents said they would spend more on overseas trips, which was down by 0.9 % points from the previous year. Travellers'efforts to reduce costs appear to be affecting the overall components of their travels. While traveling for less than five nights in 2018 increased by 1.5% points to 76.2%, traveling for more than six nights declined by 1.6% points to 23.7%.

However, rather than just looking for cheap deals or compromising on the contents/ quality of their trips, travelers are choosing ways to spend a short period of their travel time in a more practical way. The popularity of short-distance·Asian regions, short traveling periods, and destinations offering low prices proves the given tendency. In choosing group package travel products, the importance of schedule/course increased by 3.2% points, but price went down in importance by 2.4% points, indicating that travel agencies'high-end product strategies might be effective.

5. Evaluation ; Satisfaction

Traveller's interest in overseas travel destinations was high for Southern-Europe at 54.1% which was represented by Spain and Portugal, followed by Western/Northern Europe (51.8%) and the South Pacific that stayed at 51.3%, down by 2.1% points, after having marked the highest in the previous year.

The increase of South-east Asia(▲4.6% points) and Eastern Europe(▲2.3% points) on the measure were noticeable, and the fact that those regions were the filming locations of travel entertainment T.V programs seems to have driven traveller's interest.

There was no big change in travellers' overall satisfaction with their overseas travel at 3.99 points (out of 5 points). Europe was rated the best among the 8 regions (Asia, Europe, South Pacific, Latin America, Middle East, Africa, and others) at 4.22 points, but declined by 0.08 points. The most visited country, Japan, also fell by 0.03 points to 4.03 points while the nearby-located Vietnam (3.95 points·▲0.03 points) and Taiwan(3.95 points·▲0.03 points) went up, implying a possible change in the competition structure in the Asian regions.

6. Loyalty ; Revisit Intent

Travellers' intent to revisit to their overseas travel destinations increased slightly (▲0.02 points) to 3.90 points(out of 5 points) on average, with their intent to recommend their destinations also staying similar to their revisit intention (3.91 points·No change). Europe was the best rated with 4.21 points and 4.17 points for revisit intent and recommendation intent, respectively, having gone down slightly since the previous year. Asia came in next to Europe with 3.87 points and 3.86 points for the same measures, respectively, below the average but still slightly up against the previous year (revisit intent ▲0.04 points; recommendation intent ▲0.01 points), with Sout-East Asian regions driving the growth against the previous year, featuring Vietnam (revisit intent ▲0.08 points; recommendation intent ▲0.05 points). Japan, on the other hand, declined (revisit intent ▽0.05 points; recommendation intent▽0.04 points) and its growth seems to have been put on a halt due to its lack of price competitiveness, compared with its other short-distanced destination counterparts.

※ Reference. 2018 Travel report(Engligh Ver.)

T. (III. Overseas travel behavior) 1. Overseas Travel Experience rate(p.9), 7. Companion(p.12), 9. Travel Type(p.13)

(IV. Overseas travel plan) 1. Overseas Travel Plan Rate (p.22)

Note 1) Domestic travel behavior and ‘Time left to departure’was excerpt from ConsumerInsight’s

Weekly Travel behavior and planning study

R. (V. Overseas travel behavior) 10. Reasons for Choosing Travel Destinations (p.14), 11. Main Travel Activities(p.14)

A. (III. Overseas travel behavior) 3. Travel Destination(p.10), 14. Reserving/Purchasing Channel (p.16),

15. Reserving/Purchasing Method(p.17)

(IV. Overseas travel plan) 3. Travel Destination(p.23)

Note 2) ‘Information search channel when purchasing product’was excerpt from ConsumerInsight’s

Weekly Travel behavior and planning study

V. (II. Travel trend) 2. Travel spending intent(p.6)

(III. Overseas travel behavior) 5. Travel Duration(p. 11), 16. Total travel spending(p.18)

(IV. Overseas travel plan) 14. Total Travel Spending(p.29)

Note 3) ‘The reason for choosing the package product’ was excerpt from ConsumerInsight’s

Weekly Travel behavior and planning study

E. (II. Travel trend) 6. Overseas Travel Destination Interest(p.8)

(III. Overseas travel behavior) 17. Travel Destination Satisfaction(p.19)

L.(III. Overseas travel behavior) 18. Travel Destination Revisit Inten(p.20), 19. Intent to Recommend Travel Destination(p.21)

|